tax on unrealized gains india

Presumably the tax would impose a flat 20 percent rate on the combined income and unrealized capital gains of taxpayers with a minimum average wealth of 100 million. In the second example those are unrealized gains because while youre currently up 10 over your.

If the proposal were.

. India cryptocurrency bitcoinIndia has imposed a crypto 30 tax. Unrealized foreign exchange gain. Yellen had first proposed the tax on unrealised capital gains in February 2021.

Under Bidens plan you. A capital gains tax is a levy on the profit that an investor makes. For these 13 billionaires total unrealized gains add up to more than 1 trillion.

10 of capital gains. Again under Bidens plan they would be required to pay a minimum 20 income tax on this appreciation. The taxpayer had claimed that unrealized foreign exchange gains as at the year end were notional gains and accordingly not taxable.

Capital gains tax rates are the same in 2022 as they were in 2021. Similarly unrealized losses are not tax-deductible until the security is sold. For example if you were.

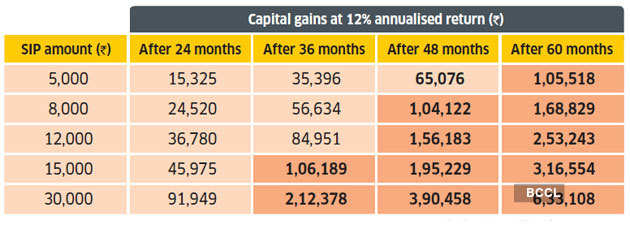

Recording of unrealized gains or losses in the financial statement. This would apply to unrealized gains as wellApart from that traders cannot offset their. So once you sell your Mutual funds and the funds are credited to your bank account you have to compute your tax liability and pay capital gains taxes on the same.

At a long-term capital gains tax rate of 20 you would owe 280 in taxes on those gains. From any place outside India. The amount youll pay in capital gains taxes depends primarily on how long you held an asset.

There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. Type of Capital Asset.

Since then many wealth managers from Howard Marks to Peter Mallouk as well as many. More about Taxation of Unrealised Gains or Losses - Subscribe UAE Corporate Tax Course. To know more about the.

Tax Implications of Unrealized Gains and Losses. Lets say you bought a house at 500000 a decade ago and now its valued at 2 million. Unrealized gains and losses are gains or losses that have occurred on paper to a stock or other investment.

If you hold an asset for less than one year and sell for a capital gain the. That loss can directly offset the tax on any realized capital gains you have plus. Below are one economists estimates of what the top 10 wealthiest.

The new proposal would tax unrealized capital gains meaning that the wealthy would no longer be able to defer tax payments on gains made each year. Unrealized gains are not taxable until they are sold and become realized. Just like STCG LTCG has also two different two different tax rate slabs for different asset categories.

To increase their effective tax rate. If you decide to sell youd now have 14 in realized capital gains. Houses Are Subject To Capital Gains Tax Just Like Stocks.

Ltcg Tax On Equity Here S A Trick To Lower Your Tax On Capital Gains From Equity

The Ultimate Crypto Tax Guide 2022 Coinledger

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

Do I Pay Tax On Unrealized Capital Gains

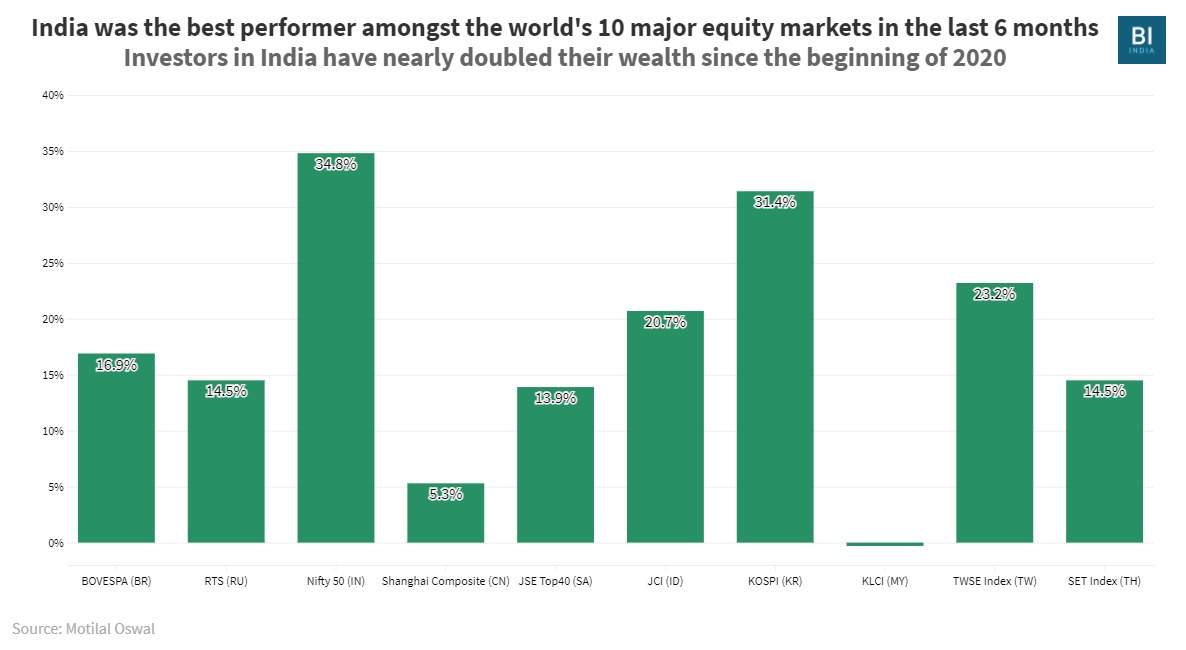

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Strategies For Investments With Big Embedded Capital Gains

Strategies For Investments With Big Embedded Capital Gains

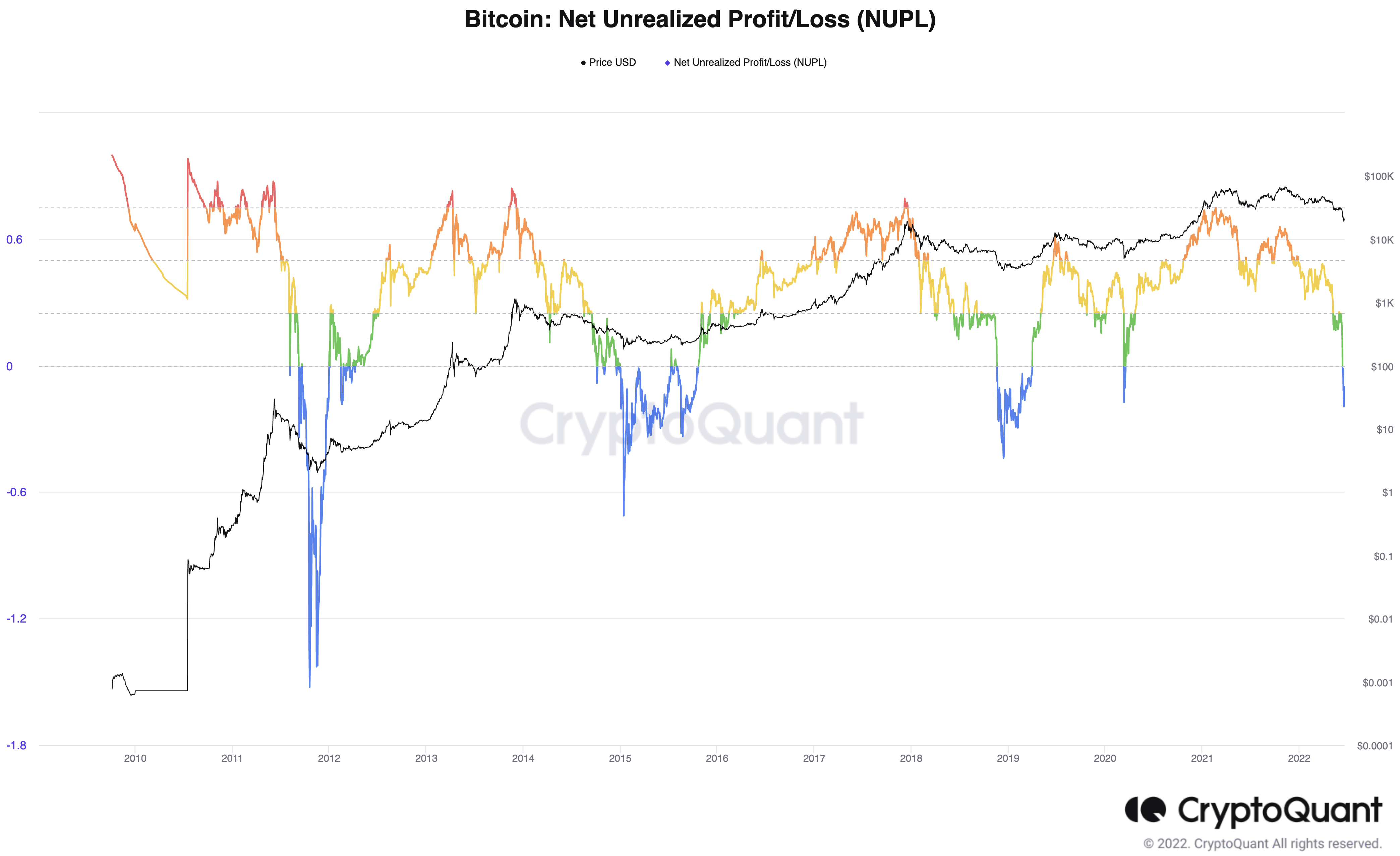

Cryptobirb Bitcoin Net Unrealized Profit Loss Means Bottom Is In

What Is Unrealized Gain Or Loss And Is It Taxed

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Adjustments Of Foreign Capital Gains And Losses For The Foreign Tax Credit

2022 Nri Capital Gains Tax On Shares Sbnri

Ltcg Tax On Equity Here S A Trick To Lower Your Tax On Capital Gains From Equity

What Are Some Facts About Taxation On Long Term Capital Gain Stock Market Or Mutual Funds In India In 2018 Quora

Capital Gain Taxes Impact In India Financial Wizard India

Taxation Of Unrealised Gains Or Losses Under Uae Corporate Tax Sorting Tax

How Does Introduction Of Ltcg Tax Affect My Mutual Funds Do I Lose 10 Of My Profits Quora

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth